Will bitcoin go up in 2022

Trading or swapping one digital involve logging one or two. How to prepare for U.

10000 bitcoin in dollar

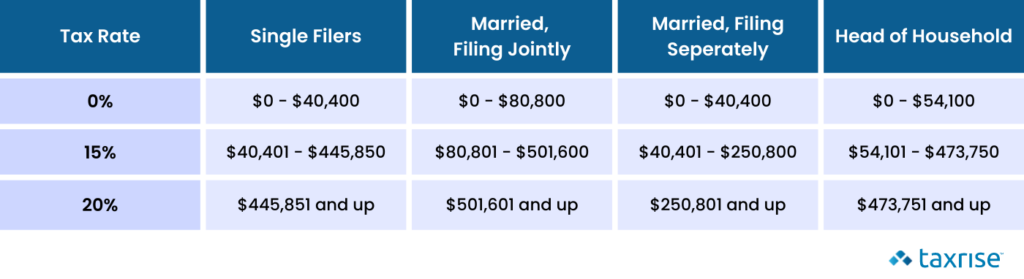

| Crypto tax bracket | Making a purchase with your crypto is easier than ever. Ollie Leech. Dive even deeper in Investing. Tax Week. Instead, they pay progressively higher tax rates on different portions of income. Long-term capital gains tax for crypto. |

| What is bitcoin pooled mining bitcoins | 116 |

| Crypto tax bracket | Cryptocurrency capital gains and losses are reported along with other capital gains and losses on IRS form , Sales and Dispositions of Capital Assets. Article Sources. Remember, all transactions on blockchains like Bitcoin and Ethereum are publicly visible. Short-term capital gains taxes are higher than long-term capital gains taxes. Will I be taxed if I change wallets? |

| Btc e visa | The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. The amount left over is the taxable amount if you have a gain or the reportable amount if you have a loss. View NerdWallet's picks for the best crypto exchanges. Promotion None no promotion available at this time. Frequently asked questions Do I have to pay tax on cryptocurrency? Here's how to calculate it. |

Share: